The Budget for 2025 in five minutes

Published

The fight against inflation has been won, and the Government is now shifting the focus of its economic policy: from fighting inflation to investing in a more prosperous and safer Sweden. The Government’s Budget Bill for 2025 includes reforms totalling SEK 60 million, excluding military support to Ukraine.

The Budget Bill contains the Government’s proposals for the central government budget for next year. On this page, you can read more about:

- The Government’s assessment of the economic situation and public finances

- Reforms in the budget to build a more prosperous and safer Sweden

- Central government expenditure and estimated revenue for 2025

The Government’s assessment of the economic situation and public finances

Economic activity has been subdued, and the Swedish economy has been in recession since 2023. This low economic activity has affected the labour market negatively, with rising unemployment and weak demand for labour. The Government expects that the recovery will begin at the end of the year, when growth and demand for labour are expected to gradually increase.

Inflation continued to decrease during the first half of 2024. Continued low energy prices and weak demand in the economy are contributing factors to the expectation that inflation will drop below 2 per cent this year and next.

General government net lending is expected to be negative for the coming two years, which means that gross debt in relation to GDP will increase in comparison with 2023. However, Sweden’s national debt remains low from a historical perspective and is lower than the debt anchor.

Macroeconomic key figures

| 2023 | 2024 | 2025 | 2026 | 2027 | |

|---|---|---|---|---|---|

| GDP¹ | -0.2 | 0.8 | 2.5 | 3.2 | 2.4 |

| Unemployment, 15–74 years² | 7.7 | 8.3 | 8.3 | 7.9 | 7.6 |

| CPIF³ | 6.0 | 1.9 | 1.7 | 2.0 | 2.0 |

| General government net lending, as a percentage of GDP | -0.6 | -1.7 | -1.3 | -0.6 | 0.4 |

| General government debt, as a percentage of GDP | 31.7 | 33.0 | 33.0 | 32.5 | 31.4 |

¹ Fixed prices.

² Per cent of labour force.

³ Consumer Price Index with fixed interest rate.

Note: Based on published statistics up to and including 5 August 2024 and 10 August 2024 respectively for general government net lending and general government debt.

Sources: Statistics Sweden and own calculations.

Reforms in the budget to build a more prosperous and safer Sweden

The Government is presenting a budget with reforms totalling SEK 60 billion, excluding military support to Ukraine. The Government wants to support the Swedish economy’s recovery and prioritises reforms to restore household purchasing power, reinstate the work-first principle and increase growth. Below you can read more about the policies in the Budget Bill for 2025.

To build a more prosperous Sweden, the Government’s growth agenda will also focus on investments in research, infrastructure and electricity supply. To promote food security, measures are being taken to strengthen Swedish food production.

It will take several years before household purchasing power returns to the level it was at prior to the dramatic inflation surge. The Government therefore intends to support the recovery through proposals that strengthen household purchasing power. For more people to be able to support themselves through salaries from work, the Government is taking additional steps to strengthen the work-first principle. With the budget proposals, the Swedish tax burden is expected to be at its lowest level since 1980.

For access to cutting-edge expertise in Sweden to increase, education and expertise need to be more worthwhile. Reduced marginal tax on labour is an important part of this. The Government is also taking measures to ensure that more people can improve their financial resilience through savings, while at the same time counteracting over-indebtedness. It should be more worthwhile to save and less worthwhile to accumulate unsecured debt.

Sweden pursues an ambitious climate policy. We assume our responsibility as an individual country and as part of the EU. Sweden already has among the lowest territorial emissions levels in the EU, and our electricity production is almost entirely fossil-free. Through effective climate policy, the Government is laying the groundwork for reaching the climate goals with a view to completely phasing out fossil fuels. Electrification of industry and the transport sector are at the core of the climate transition. The Government estimates that the overall policy in the budget will result in reduced emissions and in achieving the Effort Sharing Regulation (ESR) commitments by 2030.

Providing good conditions for Sweden’s entrepreneurs is a basic prerequisite for increased growth. A reduced regulatory burden and simplified rules facilitate enterprise for large and small businesses alike, so that they can focus on their core activities. Every krona paid in tax should be used effectively. It is therefore important that central government reviews its administration so that it is effective and fit for purpose, without unnecessary additional costs.

Security has become the great issue of freedom of our time. Organised crime is a serious threat to an open democratic society, the individual’s rights and freedoms, and the underpinnings of our state governed by law. Serious organised crime continues to claim lives, and has now spread from the major cities to smaller towns and from adults to children. Preventive measures are critical to giving every child an honest chance and to detecting risk signals at an early stage.

Russia’s full-scale invasion of Ukraine has fundamentally changed Sweden’s and Europe’s security situation . In light of this, and as a NATO member, Sweden faces a historic total defence decision. In line with the Defence Commission’s proposals, the Government proposes allocating substantial funds to finance the proposals in the defence policy bill that will be presented to the Riksdag in the coming months.

Sweden must continue to be a country with a reliable welfare system. The Government is continuing its efforts to create better conditions for preschools and schools, and to restore a strong knowledge-based school system. The Government is also working to structurally improve health care, through measures such as improved accessibility. To enable measures that safeguard future welfare, benefits must be more fit for purpose and the public sector’s resources used more effectively.

Swedish migration policy is undergoing a paradigm shift, and the Government has a concrete reform agenda aimed at solving a large number of migration-related social problems. The reforms are intended to lead to a responsible and restrictive migration policy, and a better-functioning integration policy.

Swedish aid policy will continue to be generous. Announcing a new three-year framework for the years 2026–2028 provides greater predictability for development assistance. The levels for the development assistance framework should correspond to the Government’s aid policy priorities and enable continued and substantial support to Ukraine.

Below you will find the table on reforms that presents the Government’s investments in figures.

Central government expenditure and estimated revenue for 2025

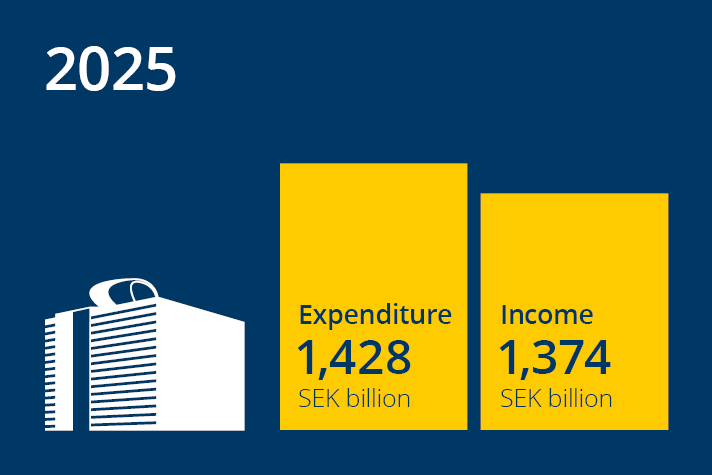

The central government expenditure proposed for 2025 totals SEK 1 428 billion. Central government income is expected to total SEK 1 374 billion in 2025. Central government finances are therefore expected to show a deficit of approximately SEK 55 billion in 2025.

Next step – the Riksdag processes the draft budget

When the Government has presented the Budget Bill, the Riksdag’s processing begins. It considers the draft budget in two different steps:

Step 1: First, the Riksdag adopts the guidelines for economic policy and the economic framework of the central government budget. The decision on the economic framework – known as expenditure frameworks – guides the continued processing in the Riksdag, as the expenditure frameworks cannot be exceeded. This decision is usually referred to as the framework decision.

Step 2: In the second step, the Riksdag decides how to divide up expenditure in each individual expenditure area, in other words, how much money different activities will receive. Processing of the Budget Bill is complete once the Riksdag has decided on the proposals for all expenditure areas.

X

X